Well its 2011, and now we’ll have to talk about the Deepwater Horizon disaster as last year’s oil spill. Unfortunately, we can’t make a New Year’s resolution to shed the far-reaching and lingering impacts in the Gulf of Mexico. We can, however, resolve to keep the story alive and hopefully learn from these mistakes and injustices.

With the Christmas holidays and sluggish interim until New Year’s, it has been a pretty slow news week. Unsurprisingly, the AP’s annual poll of news editors voted the Gulf oil spill the top news story of 2010–it was kind of hard to ignore from April until September.

I’m sure many people are secretly (or publically) wishing for the demise of BP p.l.c, but months later the Gulf spill now seems like a chip on the shoulder of an otherwise sturdy company. The AP reports:

Cleanup, government fines, lawsuits, legal fees and damage claims will likely exceed the $40 billion that BP has publicly estimated, according to an Associated Press analysis. But they’ll be far below the highest estimates made over the summer by legal experts and prominent Wall Street banks, such as Goldman Sachs, which said costs could near $200 billion

BP will survive the worst oil spill in U.S. history for several key reasons: it has little debt; its global businesses are forecast to generate $26 billion next year in cash flow from operations; the environmental impact of the spill isn’t as bad as feared; and the government seems unlikely to ban BP from Gulf drilling. To bolster its finances, BP has cut its dividend, issued debt and sold more than $21 billion in assets.

…The AP analysis shows the company is likely to face $38 billion to $60 billion in spill-related costs. A settlement with the federal government could reduce that amount, while a successful class-action lawsuit could add billions more.

Stock prices are inching their way back up–pre-spill share prices on April 20 were $60.48, dipping to a low of $27.07 on June 25, and now back up to $44.11 as of this week. If I wasn’t morally opposed to it, that would have made a damn good investment (although one of BP’s cost-saving measures was to suspend shareholder dividends this year, so maybe not).

Exxon never lost its perch among industry leaders, and BP won’t either, says Citigroup’s [Mark] Fletcher. BP remains among the top oil drillers in a world that runs on petroleum, and that may be the best way to judge the company’s lasting power. “Did (Valdez) stop anyone from buying Exxon gasoline? No. Exxon’s results are better than anyone’s on a multiyear basis,” Fletcher said.

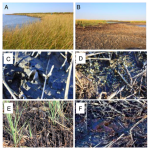

Meanwhile, theres’s STILL oil on 168 miles of Louisiana coast:

Someone please hurry up and churn out those electric cars.

I just want to say that I am relieved to be able to find a very recent article on the BP oil spill. I agree that we need to keep awareness that this problem has certainly no yet to go away, and will more than likely stay around for our grandchildren.

Let’s not forget, let’s ride our bikes, use public transit, and when the electric car becomes widely available let’s buy one!

Thank you for writing this.

“the environmental impact of the spill isn’t as bad as feared”- citation needed.

I have to say I’m disappointed BP isn’t crippled by all of this. I stopped buying BP gasoline, and I know several people who also boycott. I’ve noticed that none of the BP gas stations around me are as full as they were pre-spill.

I know its not much… but I’d like to say that yes, the Valdez did stop ME from buying from Exxon. I havent filled one drop of Exxon gas in my cars since the Valdez. And I wont use BP anymore either.

Obama sure did BP another favor when he appointed the corporation’s friend Feinberg to handle claims. They are so far under the estimate because they don’t pay legitimate claims. There are life-long fishermen that haven’t seen a check in ten-months. Feinberg has been great at giving the run-around and changing the deal but he still collects his $850,000/month from BP. Meanwhile people are sick and racking up medical bills in the thousands. And for some reason, Corexit 9527A is still being shipped and used long after the well was “sealed” (176 containers shipped in August are empty in November). So the nightmare still continues for the Gulf coast residents and I don’t think any of them care how well BP is doing, because it doesn’t seem like they are gonna pay or clean up their mess. Corexit does such a good job of hiding the oil and Obama’s point man for claimants works for BP. So Feinberg can knock off early and help his other clients like Exxon, Dow or DuPont.